|

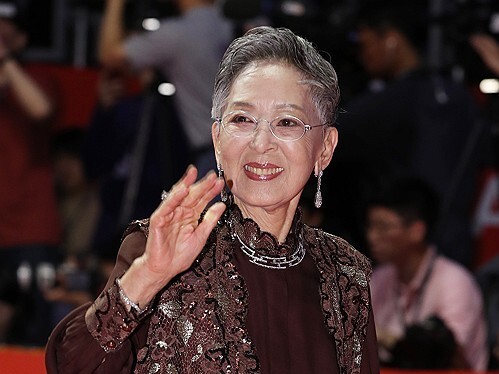

| ▲ This photo shows a dealing room at Hana Bank in central Seoul on April 11, 2025. (Yonhap) |

(LEAD) stocks-summary

(LEAD) Seoul shares end lower on escalating U.S.-China tariff row

(ATTN: ADDS bond yields at bottom)

SEOUL, April 11 (Yonhap) -- South Korean stocks finished lower Friday amid an intensifying trade conflict between the United States and China stemming from Washington's reciprocal tariff scheme. The Korean won rose against the U.S. dollar.

The benchmark Korea Composite Stock Price Index (KOSPI) lost 12.34 points, or 0.5 percent, to close at 2,432.72.

Trade volume was moderate at 361 million shares worth 7.61 trillion won (US$5.25 billion). Winners, however, beat losers 536 to 340.

Foreigners sold a net 688.5 billion won worth of stocks, while individuals and institutions combined purchased a net 571.5 billion won.

Overnight, Wall Street, which rallied the previous session from U.S. President Donald Trump's pause on reciprocal tariffs for 90 days, plunged amid the intensifying tit-for-tat retaliatory tariff measures between Washington and Beijing.

The S&P 500 dropped 3.46 percent, the Dow Jones Industrial Average fell 2.5 percent, and the tech-heavy Nasdaq composite tumbled 4.31 percent.

"The tariff war dynamic has now shifted to a one-on-one standoff between the U.S. and China," said Han Ji-young, an analyst at Kiwoom Securities, while advising investors to monitor developments rather than make hasty sell decisions.

Market bellwether Samsung Electronics plunged 2.13 percent to 55,200 won, while its chipmaking rival SK hynix dropped 1.31 percent to 180,800 won.

Leading battery maker LG Energy Solution plummeted 4.01 percent to 335,000 won, and top automaker Hyundai Motor lost 5.08 percent to end at 177,500 won.

Steel giant POSCO Holdings shed 2.3 percent to end at 255,000 won and SK Innovation retreated 4.79 percent to 97,300 won.

The local currency was trading at 1,449.9 won against the U.S. dollar at 3:30 p.m., up 6.5 won from the previous session.

Bond prices, which move inversely to yields, rose. The yield on three-year Treasurys fell 2.6 basis points to 2.411 percent, and the return on the benchmark five-year government bonds dropped 0.4 basis point 2.519 percent.

(END)

(C) Yonhap News Agency. All Rights Reserved