|

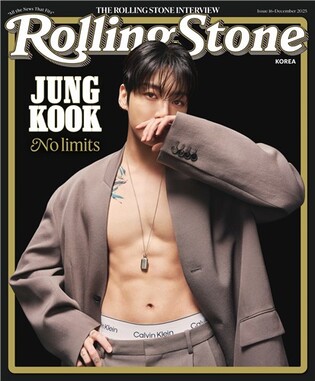

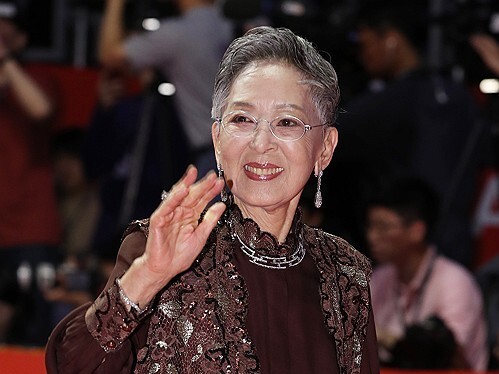

| ▲ A dealing room at Hana Bank in central Seoul on July 21, 2025 (Yonhap) |

(LEAD) stocks-summary

(LEAD) Seoul shares end higher on extended foreign buying

(ATTN: ADDS bond yields at bottom)

SEOUL, July 21 (Yonhap) -- Seoul shares closed higher Monday, driven by an extended foreign buying binge amid lingering concerns over U.S. tariff measures. The Korean won rose against the U.S. dollar.

The benchmark Korea Composite Stock Price Index (KOSPI) added 22.74 points, or 0.71 percent, to close at 3,210.81.

Trade volume was a little slim at 341.3 million shares worth 10.6 trillion won (US$7.6 billion), with losers outnumbering winners 489 to 390.

Foreign investors purchased 893.4 billion won worth of local shares, while institutions bought 101.3 billion won. Retail investors dumped 1.06 trillion won worth of shares for profit-taking.

"Foreigners continued the purchases of Seoul shares for the eighth consecutive session amid positive evaluation of the KOSPI by global investment banks," said Lee Kyoung-min, an analyst at Daishin Securities.

On Friday, Wall Street closed mixed as concerns over U.S. President Donald Trump's administration's tariff policies offset the risky appetite caused by strong U.S. retail sales data.

The Dow Jones Industrial Average shed 0.32 percent, and the S&P 500 edged down 0.01 percent, while the tech-heavy Nasdaq composite inched up 0.05 percent.

Over the weekend, U.S. Commerce Secretary Howard Lutnick said Aug. 1 is a "hard deadline" for Washington's reciprocal tariffs, pressuring its major trading partners to swiftly come up with terms of trade negotiations.

In Seoul, tech giant Samsung Electronics rose 1.04 percent to 67,800 won, and its chipmaking rival SK hynix gained 1.3 percent to 272,500 won.

Leading battery maker LG Energy Solution jumped 2.64 percent to 331,000 won, and defense powerhouse Hanwha Aerospace advanced 2.57 percent to 919,000 won.

Major power plant manufacturer Doosan Enerbility soared 5.56 percent to 68,400 won, and steel giant POSCO Holdings surged 5.14 percent to 327,000 won.

Leading shipbuilders Hanwha Ocean and HD Hyundai Heavy rose 4.98 percent and 4.81 percent to 84,400 won and 425,000 won, respectively.

Renewable energy firm Hanwha Solution shot up 7.37 percent to 37,900 won on forecasts the company will swing to a profit in the second quarter.

On the other hand, top automaker Hyundai Motor lost 0.71 percent to 209,000 won, and Naver, South Korea's biggest internet portal operator, went down 0.83 percent to 240,000 won.

The local currency was quoted at 1,388.2 won against the U.S. dollar at 3:30 p.m., up 4.8 won from the previous session.

Bond prices, which move inversely to yields, closed higher. The yield on three-year Treasurys fell 1.8 basis points to 2.456 percent and the return on the benchmark five-year government bonds declined 1.7 basis points to 2.628 percent.

(END)

(C) Yonhap News Agency. All Rights Reserved