|

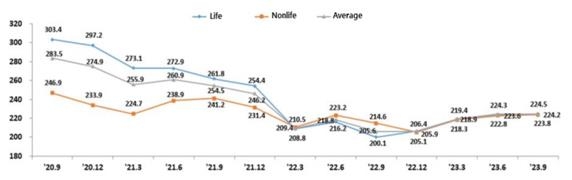

| ▲ This graph, provided by the Financial Supervisory Service on Jan. 16, 2024, shows the capital adequacy ratios of South Korean insurance companies. The average capital adequacy ratios of insurance firms had come to 224.2 percent as of end-September, up 0.6 percentage point from three months earlier. (PHOTO NOT FOR SALE) (Yonhap) |

insurance firms-capital adequacy

Insurance firms' capital adequacy improves in Q3

SEOUL, Jan. 16 (Yonhap) -- South Korean insurance companies' capital adequacy ratio continued to improve in the third quarter from three months earlier, data showed Tuesday.

The average capital adequacy ratio of local insurance firms had come to 224.2 percent as of end-September, up 0.6 percentage point from the previous quarter, according to the data from the Financial Supervisory Service (FSS)

The increase marks a slowdown from a 4.7 percentage-point on-quarter increase in the second quarter.

The FSS attributed the increase to a rise in new insurance contracts in the July-September period, as well as a decrease in insurance contract liabilities, which "contributed to the growth in available capital from three months earlier."

The ratio refers to the amount of available capital compared with required funds under the Korean Insurance Capital Standard, or K-ICS, implemented last year to require insurers to maintain their fiscal soundness.

The capital adequacy ratio for life insurers had come to 224.5 percent as of end-September, up 0.2 percentage point from three months earlier, while that of nonlife insurance companies added 1.1 percentage points to 223.8 percent over the cited period, according to the FSS.

As of end-September, available capital of the local insurance firms had stood at 261.7 trillion won (US$198.2 billion), up 2.2 trillion won from three months earlier, the financial regulator added.

(END)

<저작권자(c) 연합뉴스, 무단 전재-재배포, AI 학습 및 활용 금지>

(C) Yonhap News Agency. All Rights Reserved

![[가요소식] 조항조, 새 싱글 '아버지란 그 이름' 발표](https://korean-vibe.com/news/data/20251116/yna1065624915927473_582.jpg)