|

| ▲ K-pop girl group Babymonster is seen in this photo provided by YG Entertainment. (PHOTO NOT FOR SALE) (Yonhap) |

SEOUL, April 9 (Yonhap) -- Despite concerns about the K-pop industry since last year, new K-pop idol groups continue to emerge as if they've been eagerly awaited this year.

Since January, approximately 10 rookie idol groups have already made their debut, with announcements coming at a pace of 3-4 teams per month.

In the midst of this, a clear disparity in popularity is emerging between idols from major and mid-sized entertainment agencies.

◇ Influx of Rookies Amidst K-pop Crisis, Continued Expectations for the Global Market

According to the music industry on the 9th, last month, four rookie girl groups jumped into the K-pop scene by holding showcases over three days.

These included ILLIT under HYBE's subsidiary, UNIS from the audition program 'Universe Ticket,' CANDY SHOP produced by songwriter Brave Brother, and RESCENE under The Muze Entertainment.

On the 1st of this month, YG Entertainment's rookie girl group BABYMONSTER officially debuted, and girl groups VVUP and SPIA also stepped up to the challenge.

Rookie boy groups have also been throwing their hats into the ring at a rate of 2-3 teams per month this year.

Teams like TWS under HYBE's Pledis, ALL(H)OURS under Eden Entertainment, and the first boy group DXMON from SSQ Entertainment all debuted in January.

In February, SM Entertainment's rookie NCT WISH and the newcomer NOMAD, whose debut album was overseen by renowned producer DK, kicked off their activities.

Additionally, girl groups like UNICODE are poised to debut this month, and labels led by TEDDY such as DOUBLE BLACK LABEL and BIG PLANET MADE have also hinted at debuting girl groups in the first half of the year.

Entertainment agencies are churning out rookie idols tirelessly due to the expectations placed on the global K-pop market.

Despite the spreading concerns about the K-pop crisis since last year, they are leaping into competition by using growth figures that continue to show promise.

According to the customs agency, the export value of physical K-pop albums last year reached approximately 380 billion won, an increase of 25.5% from the previous year, setting a new record high.

Notably, smaller agencies like FIFTY FIFTY and Xikers gained global popularity last year, aiming for a so-called 'big hit.'

A representative from a major entertainment agency mentioned, "When K-pop music is released, it garners interest as a global genre," explaining the recent situation as a time when a Korean debut is considered synonymous with a global debut.

However, another music industry insider expressed concerns, stating, "It seems like agencies are releasing rookies only by looking at successful cases amidst a serious situation of the rich getting richer and the poor getting poorer," cautioning that everyone might be falling into an illusion.

|

| ▲ ILLIT, a new-face girl group from Hybe, is seen in this photo provided by the K-pop company. (PHOTO NOT FOR SALE) (Yonhap) |

◇ Trend of Popularity Focused on Major Agency Rookies... "Fanbase and Capital Outperforming"

Amidst fierce competition among entertainment agencies, there is a noticeable trend of popularity leaning towards rookies from major agencies.

Both ILLIT and TWS under HYBE secured 1st place on terrestrial music shows with their debut songs, and as of the 8th, ILLIT's 'Magnetic' topped Melon's 'Top 100' chart, while TWS' 'The First Meeting Didn't Go as Planned' ranked 3rd.

In particular, ILLIT achieved the feat of placing on the UK Official Singles Chart 'Top 100' at 80th with 'Magnetic,' making it the first debut song by a K-pop group to do so.

BABYMONSTER also made waves by entering Spotify's daily top song chart with their new song 'SHEESH,' setting off to secure a global fandom.

Their debut mini-album featuring 'SHEESH' surpassed sales of 400,000 copies in the first week of release, setting a record for the highest first-week sales by a debut album from a K-pop girl group.

NCT WISH surpassed sales of 280,000 copies in the first week of their new release and set records such as 1st place on Japan's Oricon Daily Single Chart and 1st in seven regions on iTunes' Top Album Chart.

In contrast, debut album sales in the first week for rookie idols from mid-sized agencies are only 1/10 to 1/5 of those from major agencies, making it difficult to find them on major domestic music charts.

The music industry views it as inevitable that major agencies dominate the rookie idol market in terms of established fanbases, systems, and financial resources.

For instance, among BABYMONSTER's overseas fandom, a significant proportion consists of existing BLACKPINK fans.

TWS has been building recognition by being labeled as 'SEVENTEEN's younger brother group,' and NCT WISH effectively drew interest from the existing NCT fandom as the final unit of the NCT group.

A representative from a major entertainment agency explained, "Being under a major agency means being known from the trainee days, and there's also a kind of 'drip effect' that comes from major artists of the agency," highlighting the advantages.

Moreover, the diverse promotional avenues available, including short-form viral marketing and overseas broadcast appearances via numerous social networking services (SNS) channels, favor large agencies with ample financial resources.

Some corners of the music industry express concerns that the concentration phenomenon overseas could worsen in the future.

A music industry representative mentioned, "After COVID-19, K-pop consumers with limited spending power are making selective choices as idols increasingly expand overseas performances," citing a situation where the majority of idols are experiencing poor ticket sales overseas.

|

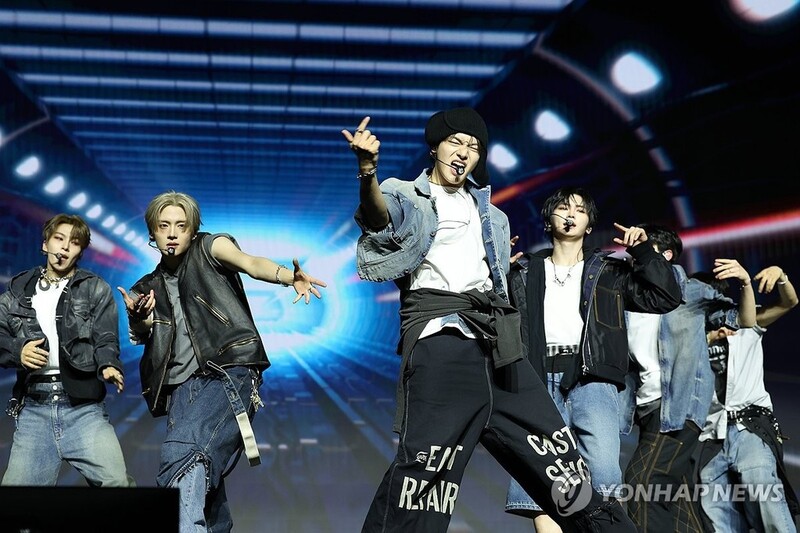

| ▲ K-pop boy group xikers perform during a media showcase for its upcoming third EP, "House of Tricky: Trial and Error," in Seoul on March 7, 2024. (Yonhap) |

(C) Yonhap News Agency. All Rights Reserved

![[가요소식] 지드래곤, 中 QQ뮤직 '올해의 K팝 앨범' 수상](https://korean-vibe.com/news/data/20260112/1768207788_yna1065624915979655_960.jpg)