|

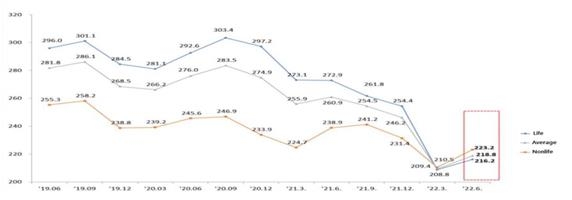

| ▲ This graph, provided by the Financial Supervisory Service on Oct. 10, 2023, shows the capital adequacy ratios of South Korean insurance companies. The average capital adequacy ratios of insurance firms came to 223.6 percent as of end-June, up 4.7 percentage points from the previous quarter, under the newly implemented Korean Insurance Capital Standard. (PHOTO NOT FOR SALE) (Yonhap) |

insurance firms-capital adequacy

Insurance firms' capital adequacy improves in Q2 on decline in liabilities

SEOUL, Oct. 10 (Yonhap) -- South Korean insurance companies saw their capital adequacy ratios improve in the second quarter from three months earlier, helped by a decline in insurance liabilities thanks to high interest rates, data showed Tuesday.

The average capital adequacy ratio of local insurance firms came to 223.6 percent as of end-June, up 4.7 percentage points from the previous quarter, according to the data released by the Financial Supervisory Service.

The data was based on the newly implemented the Korean Insurance Capital Standard, a new regulation implemented this year to stipulate insurers to maintain a capital adequacy ratio of 100 percent or above as part of efforts to keep their fiscal soundness.

The ratio for life insurance companies increased 4.9 percentage points on-quarter to 224.3 percent, and the ratio for non-life insurers rose 4.4 percentage points to 222.7 percent.

As of end-June, a total of 19 insurance companies have adopted transitional measures for the new regulation.

(END)

(C) Yonhap News Agency. All Rights Reserved